|

|

|

Broker analysts reviewing the report like Mike Hughes, Vice President and General Manager for Downing-Frye Realty, Inc., speculate that “even though buyers today are facing headwinds like high interest rates, rising property and flood insurance rates, and low inventory levels, these factors are not diminishing people’s desire to live in Naples.”

Cindy Carroll, SRA, of Carroll & Carroll Appraisers & Consultants, LLC, who advocates against comparing activity today to activity during the COVID-boom years (2020-2022), said she is “comforted by the fact that our area shows resilience to 2019. Homebuyers shouldn’t get too hung up on the months of inventory number reported because it fluctuates wildly depending on where you want to buy a home in Naples. For example, the Port Royal area has a 1.3 year supply today. The truth is we are heading back to 2019; a time when the housing market was stable, foundational, and logical. That is what should be happening, and it is.”

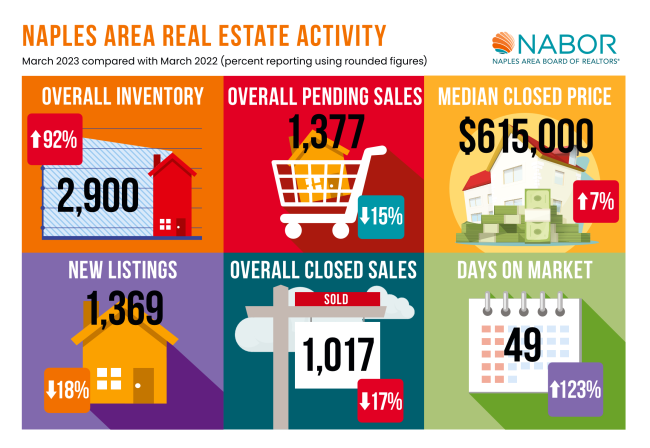

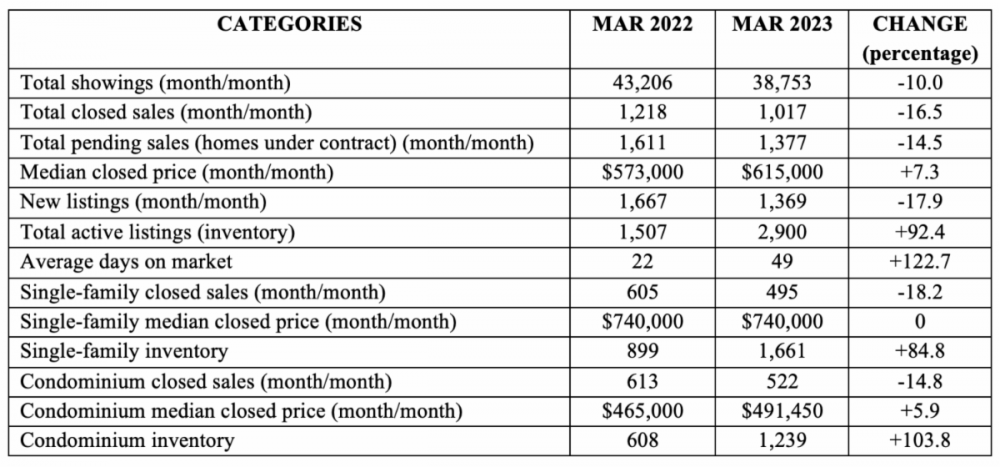

With this more accurate comparative method in mind, closed sales decreased 16.5 percent to 1,017 closed sales from 1,218 closed sales in March 2022; but compared to March 2019, closed sales increased 2.6 percent. Pending sales in March decreased 14.5 percent to 1,377 pending sales from 1,611 pending sales in March 2022; but compared to March 2019, pending sales increased 22 percent.

While new listing growth was relatively static in the first quarter of 2023, Wes Kunkle, President and Managing Broker at Kunkle International Realty, believes some potential sellers in Naples are sitting on the fence because they fear a possible recession may impact their home’s value and/or want to wait and see whether interest rates drop. New listings during March decreased 17.9 percent to 1,369 new listings from 1,667 new listings in March 2022; but compared to March 2019, new listings for the month decreased only 2.5 percent. Yet according to Adam Vellano, a Naples Sales Manager at Compass Florida, “the price decreases reported in March were by sellers who failed to price their homes competitively when they originally listed them, but very few of these decreases were below today’s comps.”

The NABOR® March 2023 Market Report provides comparisons of single-family home and condominium sales (via the Southwest Florida MLS), price ranges, and geographic segmentation and includes an overall market summary. NABOR® sales statistics are presented in chart format, including these overall (single-family and condominium) findings for 2023:

However, an experienced Naples REALTOR® understands the comparative market differences of each unique neighborhood.

Kunkle added that it’s become a “hard decision to sell a home if you have a mortgage at a 3 percent interest rate when today’s rates are over 6 percent.” However, according to Freddie Mac, the average 30-year fixed rate mortgage since 1971 is 7.75 percent. Further, Sherry Stein, CRB, Managing Broker, Berkshire Hathaway HomeServices, was quick to point out that “the average sales price in Naples in March 2019 was $597,081, but today it’s $1,018,469.”

For a detailed market report on any neighborhood, feel free to contact Debbie Kroeger at 239-777-2966.